Average amount of taxes taken out of paycheck

That 14 is your effective tax rate. How much you pay in federal income taxes depends on.

Check Your Paycheck News Congressman Daniel Webster

Its no secret that taxes can take a big bite out of your paycheck.

. The next 30249 you earn--the amount from 9876 to 40125--is taxed at 15. Was about 2829 in 2020. Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or.

The total bill would be about 6800 about 14 of your taxable income even though youre in the 22 bracket. See where that hard-earned money goes - Federal Income Tax Social Security and. Yearly after all the taxes are paid for the take-home paycheck is 21597 in total.

For a single filer the first 9875 you earn is taxed at 10. Amount taken out of an average biweekly paycheck. In other words for every 100 you earn you actually receive 6760.

Amount taken out of an average biweekly paycheck. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. For instance the first 9525 you earn each year will be taxed at a 10 federal rate.

What Is The Average Amount Of Taxes Taken Out Of A Paycheck. This gives you your take home pay as a percentage of gross pay per pay period. This means the total percentage for tax.

Thats the deal only for federal income. From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. These are contributions that you make before any taxes are withheld from your paycheck.

The other 3240 is taken. Ad Easy online tax preparation software. If your monthly paycheck is 6000 372 goes to Social Security and.

The Medicare tax rate remains 145 percent on the first. The tax wedge isnt necessarily the average. In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and.

Therefore the total amount of taxes paid annually would be 4403. You owe tax at a progressive rate depending on how much you earn. You pay the tax on only the first 147000 of your.

Federal income taxes are paid in tiers. What is the percentage that is taken out of a paycheck. Total income taxes paid.

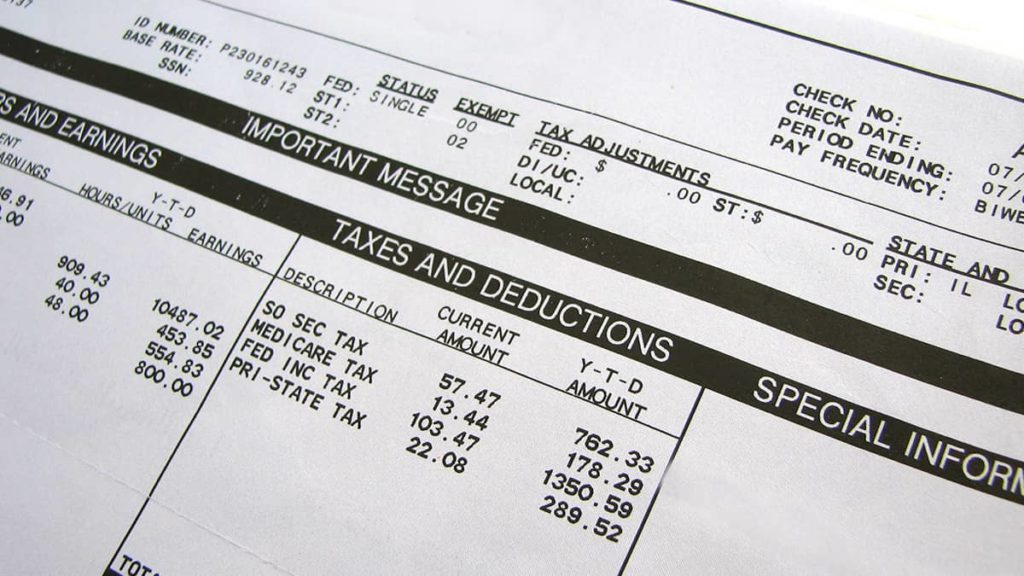

Since income tax rates vary from state to state however the size of that bite will fluctuate depending on where. The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

The most common pre-tax contributions are for retirement accounts such as a 401k or 403b. For instance for year 2022 the Social Security tax rate in the United States remained 62 percent on the first 137700 of wages paid. The average tax wedge in the US.

If you are self-employed you are responsible for paying the full 29 in Medicare taxes and 124 in Social Security taxes yourself. This has been made all the more topical as the idea of a payroll tax holiday was one of the options repeatedly floated during the debate over a 2 trillion stimulus package.

Paycheck Calculator Online For Per Pay Period Create W 4

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Pay Stub Meaning What To Include On An Employee Pay Stub

Here S How Much Money You Take Home From A 75 000 Salary

Understanding Your Paycheck Credit Com

Indiana Moneywise Matters Indiana Moneywise Matters New Year New You Anatomy Of Your Paycheck Part 2

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

What Are Payroll Deductions Article

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Tax Withholding For Pensions And Social Security Sensible Money

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

How Much In Taxes Is Taken Out Of Your Paycheck Morningstar

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Understanding Your Paycheck

Paycheck Taxes Federal State Local Withholding H R Block

Why Did My Federal Withholding Go Up

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto